Bitcoin’s Impact on the Global Financial System

Bitcoin is a well-known blockchain-based cryptocurrency created in 2009 by an anonymous named Satoshi Nakamoto.

Since then, Bitcoin has gone from being a common digital asset to becoming a big deal in digital currencies.

Many people believe Bitcoin is more reliable than traditional cash since it runs on a peer-to-peer network and is not regulated by a central body.

Transactions are processed and verified by a distributed system of computers known as nodes and recorded on a digital ledger known as the Blockchain, which significantly influences the global financial system.

Cashless traditions have existed since before civilization, based on barter and other transaction forms. Being cashless has become the norm in today’s society.

Society is returning to a cashless society; transactions are now accessible thanks to the use of credit cards, debit cards, mobile payments, and digital currencies such as Bitcoin.

However, this does not imply that society is transforming into a “moneyless community.”

Money is still the central part of all financial transactions; it is just that the number of people adopting virtual money is increasing daily.

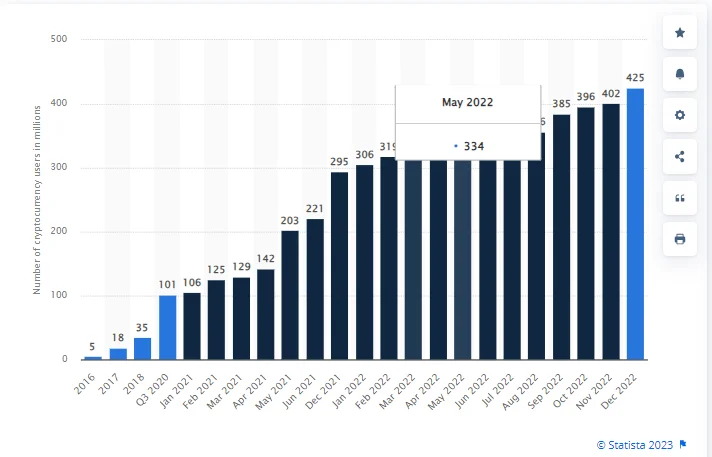

Crypto popularity soared between 2016 and 2022, with the number of cryptocurrency investors worldwide surging around 426%. Bitcoin adoption persisted in 2021 as businesses like Voyager Digital, Mastercard, etc., declared their interest in cryptocurrencies.

In 2022, customers in Africa, Asia, and South America were among the cryptocurrency holders, which includes Bitcoin.

According to research, between 2.9 million and 5.8 million active unique Bitcoin wallets exist.

At least 1,876 people work full-time in cryptocurrency-related enterprises; this indicates that Bitcoin is more than just digital money that the general public has adopted. It has become an evolution.

The unique features of Bitcoin are:

- It is decentralized, does not depend on any governmental authority, and involves mining, which can be done on Rollercoin, and transaction verification by blockchain networks.

- It is transparent.

- It is fast and processes payments instantaneously.

From the above, it is apparent that there is a big difference between Bitcoin and traditional currency. Financial institutions are already seeing the effects of its use and adoption. Here’s how Bitcoin impacted the global financial system.

Change in Investment Strategies

Most investors have always chosen traditional investment alternatives. However, with the emergence of Bitcoin, this trend has shifted as modern investors attempt to include Bitcoin in their investing portfolios.

This trend is motivated by the notion that Bitcoin can continue to perform well even when traditional assets such as stocks and bonds lose value owing to factors such as inflation.

However, other analysts are concerned that Bitcoin may encounter troubles or collapse, potentially resulting in a global financial disaster.

Nonetheless, some crypto investors see Bitcoin as a wise strategy to preserve their investment from the corrosive impacts of inflation.

So, they’re choosing to also become crypto investors alongside their other assets.

This shift in thinking marks a departure from the usual investment strategies. Investors decided to create a balance between modern assets like Bitcoin and the traditional currency they had been used to.

By doing so, they will recognize Bitcoin’s unique qualities, like its limited supply, decentralized structure, and ability to hold its value even when the economy fluctuates.

Read Also: QA for ReactJS: How to Avoid Errors and Improve the Quality of Your Web Application

The Emergence of a Decentralized Market

Bitcoin has created a new market that functions independently and without the supervision of regular government agencies. Anyone can buy and sell Bitcoin without banks or other financial institutions.

With time, this online space might evolve into an organized entity capable of overseeing and managing this disruptive market.

The almost low transaction costs of Bitcoin fueled the increasing popularity of this new market. Making Bitcoin a more appealing option than regular currencies, especially when handling international transactions.

As this digital landscape continues to evolve, it’s shaking up the traditional ways we think about finance and business. It’s sparking innovation, efficiency, and financial inclusion.

Economic Transformation

The disruptive force of Bitcoin can entirely transform our current financial system. Consider it a game-changer that might transform banks and other financial organizations’ operations.

This digital currency can be used in deals involving banks or other middlemen. The secret sauce behind this transformation is the blockchain network.

It’s like a digital ledger that records every Bitcoin transaction. The Blockchain keeps a super-secure record of every transaction.

Bitcoin is turning the banking world on its head. It’s like giving everyday people power in how money moves around, shaking up the long-standing control that big banks and governments have had over our finances.

Read Also: DC Proxies vs. Residential Proxies: Choosing Which Is Right for You?

Popularity of Crypto Exchanges

The popularity of cryptocurrency exchanges significantly influences Bitcoin’s impact on the global financial system.

These platforms have impacted how assets are bought, sold, and traded, increasing access to Bitcoin.

They have changed what was formerly a technical and complex investment into something feasible for anyone interested in participating in the digital economy by democratizing access.

As a result, practically everyone with an internet connection can buy Bitcoin.

Final Thoughts

Bitcoin is an asset that has no central issuer and does not represent anybody’s liability. It cannot be adjusted to variations in demand.

Bitcoin shares some similarities with regular money and traditional assets such as gold, only that it is a digital currency, which makes it super easy to send and receive compared to the old-fashioned way.

Plus, it is not under the thumb of any government or big authority. This unique feature makes it quite appealing to many people and crypto investors.

Its unique characteristics have the potential to disrupt and transform global traditional finance; they also present regulatory and security challenges that will continue to evolve as the cryptocurrency ecosystem matures.

Many analysts believe Bitcoin has the potential to revolutionize the global economy.

It is and might continue to kickstart economic growth in regions where individuals need easy access to banks and investment capital.

It’s the same as a digital key that might open doors for people to new opportunities.

Uncertainty comes with change, but Bitcoin and other cryptocurrencies remain here despite certain doubts and reservations.